Medical Benefits

Welcome

Southwestern Community Services is committed to the health and wellbeing of its employees. We are proud to offer you two exceptional health plans through Harvard Pilgrim Health Care. SCS offers the Best Buy HSA HMO and Elevate Health HSA HMO plans, offering you comprehensive medical care and prescription coverage, along with the resources to help you maintain a healthy lifestyle.

Eligibility

All regular full-time employees working 30+ hours a week are eligible to enroll in health insurance. Eligibility for newly hired employees is 1st of the month following 30 days of full-time employment.

Benefit Information

How do I enroll?

Open Enrollment is your time to make new benefit elections or make changes to your current benefit elections.

Newly hired, regular full-time employees will enroll for health insurance benefits during the new employee orientation period. Eligibility begins following 30 days of continuous employment.

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next Open Enrollment period, effective January 1, 2025, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections, outside of the normal, Open Enrollment period. Examples of Qualifying Life Events include: the birth of a child, marriage, divorce and a loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining SCS’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave SCS employment?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act. COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

Summary of Benefits & Coverages

SCS is pleased to offer employees health insurance through Harvard Pilgrim Health Care for the 2024 plan year.

There are three factors that make up the overall cost of your Health plan.

Network –

A primary care physician (PCP) must be chosen for the Best Buy HSA HMO plan and the Elevate Health HSA HMO plan. Out-of-network coverage is limited to emergency or urgent care only for these plans.

The Best Buy HSA HMO plan provides access to providers in Harvard Pilgrim’s Broad New England Network, plus major Boston Hospitals, Sojourners Health and Springfield Hospital.

The Elevate Health HSA HMO plan operates on a limited network of 20 New Hampshire hospitals (including Cheshire Medical Center, Dartmouth Hitchcock, Monadnock Community), Brattleboro, VT and Boston Children’s for pediatrics with referral.

If you are enrolling in the Harvard Medical Plan you are required to add the PCP information. To locate your provider information, click on the link (“Primary Care Physician Directory Web Site”) provided to locate a provider ID. If you are not a current patient, you are responsible to establishing yourself as a patient with the provider.

How to locate a PCP

1.Online:

- Visit https://www.harvardpilgrim.org/public/find-a-provider

- Click “Select a Plan”

- Click on “HMO or HMO Open Access” for the Best Buy HSA HMO plan and “ElevateHealth HMO” for the Elevate Health HSA HMO plan.

- Enter Zip Code

- Click on the PCP icon

- Please note that the default search (Distance From You) is 10 miles from zip code, but you can change the number of miles.

- View or print the directory.

Cost To Use –

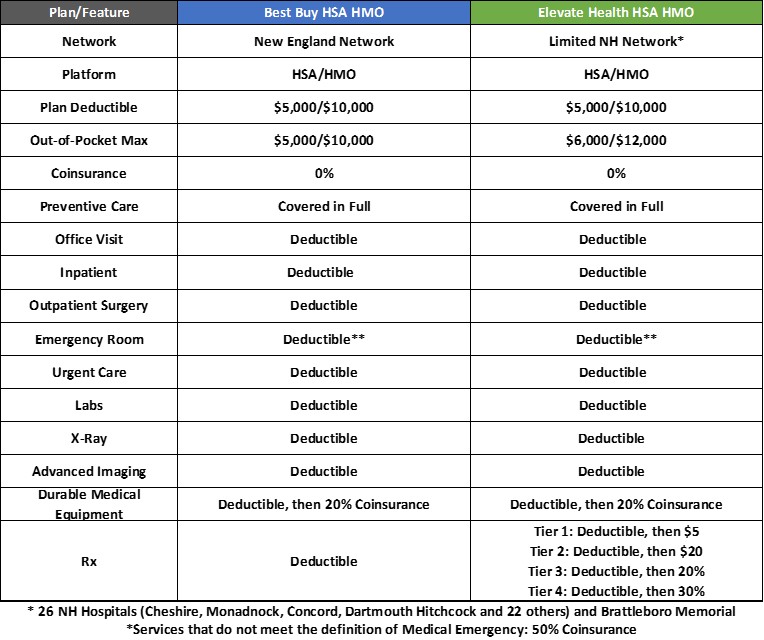

The major cost sharing components for the Best Buy HSA HMO and the Elevate Health HSA HMO are deductibles, coinsurance, and out-of-pocket (OOP) max amounts. There are no copays under either medical plan.

Deductible is the amount of deductible-eligible covered medical expenses (e.g., inpatient, outpatient, imaging, lab, ER) the member pays before Harvard Pilgrim pays benefits. The Best Buy HSA HMO has a $5,000 individual deductible and $10,000 family deductible. The Elevate Health HSA HMO has a $5,000 individual deductible and $10,000 family deductible.

Coinsurance is the amount the member pays for deductible-eligible services after meeting the deductible. The Best Buy HSA HMO has 20% coinsurance for Durable Medical Equipment, and 50% coinsurance for any Emergency Room services that do not meet the definition of a Medical Emergency. The Elevate Health HSA HMO has 20% coinsurance for Durable Medical Equipment, 50% coinsurance for any Emergency Room services that do not meet the definition of a Medical Emergency and coinsurance for some Rx.

Out of Pocket Maximum refers to the most you will pay for covered expenses under the plan. Deductibles and Coinsurance all accumulate toward the OOP Max. The Best Buy HSA HMO has an out-of-pocket max of $5,000/$10,000. The Elevate Health HSA HMO has an out-of-pocket max of $6,000/$12,000.

Where you receive your care can impact how much you pay:

- Urgent Care Centers, such as Convenient MD, are generally less expensive than Hospital Emergency Rooms

- Stand-Alone labs such as Quest Diagnostics are generally less expensive than hospital labs.

- Site of Service providers give members an opportunity to pay a copay for certain elective surgeries/services. Search using Provider LookUp.

- Reduce My Costs gives additional incentive to members who schedule elective surgeries/procedures at lower cost providers (See info on following page)

- Doctors of Demand (telemedicine)– Virtual visits

- Estimate your costs: Log into your member account and click “Tools and Resources” at the top of the page then click “Estimate My Cost”.

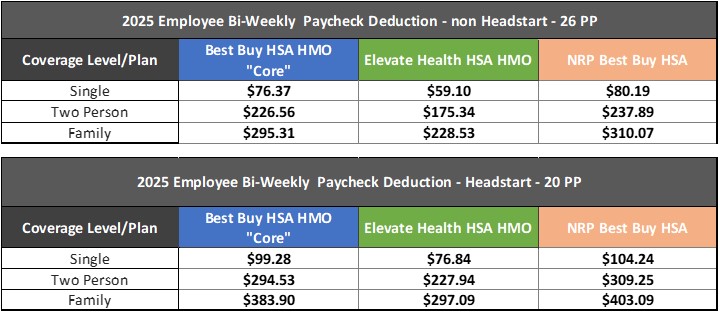

Cost To Own – The amount that will be deducted from each paycheck is listed below.

Health Plan Overview

Contributions & Rates

The chart below shows the weekly payroll deduction for various coverage levels of the plan.

Carrier Contact Information

Plan Documents

Additional Information

Health Reimbursement Arrangement (HRA)

Health Reimbursement Arrangement (HRA)

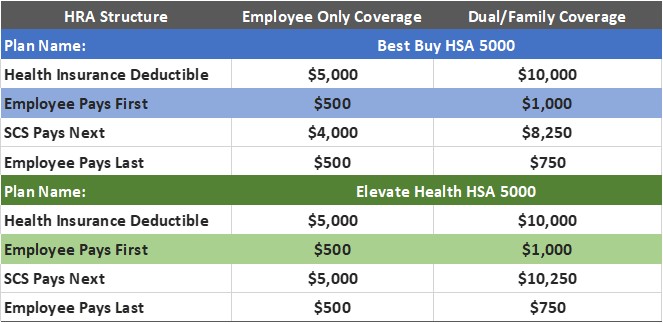

To help you pay for deductible-eligible expenses associated with your Co-op’s health insurance plan, and ultimately reduce your out-of-pocket maximum amount, Southwestern Community Services has generously established a Health Reimbursement Account (HRA) administered by csOne.

Best Buy HSA 5000:

Those covered under employee only coverage will pay the first $500, after which the HRA pays the next $4,000, after which employees will pay the next $500. After this $5,000 has been met, Harvard Pilgrim will pay in full. Employees Out-of-Pocket cost will be $1,000.

Those covered under dual/family coverage will pay the first $1,000, after which the HRA pays the next $8,250, after which employees will pay the next $750. After this $10,000 has been met, Harvard Pilgrim will pay in full. Employees Out-of-Pocket cost will be $1,750.

Elevate Health HSA 5000:

Those covered under employee only coverage will pay the first $500, after which the HRA pays the next $5,000, after which employees will pay the next $500 (Prescription only). After this $6,000 has been met, Harvard Pilgrim will pay in full. Employees Out-of-Pocket cost will be $1,000.

Those covered under dual/family coverage will pay the first $1,000, after which the HRA pays the next $10,250, after which employees will pay the next $750 (Prescription only). After this $12,000 has been met, Harvard Pilgrim will pay in full. Employees Out-of-Pocket cost will be $1,750.

You do not need to make a request or submit forms to access your HRA reimbursement. Harvard Pilgrim will electronically feed deductible related claims data to CsOne who will process your reimbursement based on the deductible data provided and according to the plan parameters listed above. The runout period for the HRA is 120 days. This means claims incurred prior to the end of the plan year, or termination, will continue to be processed for up to 120 days.

Carrier Contact Information

Flexible Spending Accounts

Flexible Spending Accounts (FSA)

SCS offers both health (FSA) and dependent care (DCA) flexible spending accounts. Employees may contribute pre-tax dollars into these accounts to help offset eligible medical expenses or dependent care expenses.

Health Care FSA

Funds from a health care FSA can be used for qualified expenses including medical, dental, vision, deductibles*, co-payments and coinsurance. For a full list of qualified expenses allowed by the IRS, see Publication 502 (www.irs.gov/publications/p502).

*You may NOT use FSA funds to pay for deductible expenses that are eligible for reimbursement under SCS’ HRA.

With an FSA, the entire elected amount is available on the first day of the health plan year.

In 2025 the maximum allowable contribution amount is $3,300.

The minimum election allowed is $250.

SCS has a 120-day runout period to process claims incurred in 2024. Balances remaining after runout period will be forfeited. “Use it or lose it”.

Dependent Care FSA

A dependent care FSA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care. To qualify for a dependent care FSA, the IRS requires that the dependent care is necessary for you or your spouse to work, look for work or attend school full-time.

In 2025 the maximum amount you may contribute to the dependent care FSA is $5,000* (if single or married & filing jointly) or $2,500* (if married & filing separately).

Please note that the DCA is 100% employee funded and is only available to use as monetary contributions are made.

Visit https://csone.com for more information including tools to calculate your tax benefits, election amount estimators, enrollment forms, direct deposit forms, or call 603-227-2000.

Dependent Care Flexible Spending Account Basics

The Dependent Care Assistance Plan (DCAP) Account is designed to help you pay for child care services for a child who is under age 13 or care for a disabled Spouse or Dependent when those services make it possible for you (or you and your Spouse if you are married and/or your Spouse is not disabled or a full-time student) to work.

You qualify for this benefit if:

- You are a single parent; or

- You have a working Spouse; or

- Your Spouse is a full-time student for at least five months during the year while you are working; or

- Your Spouse is disabled and unable to provide for one’s own care.

How do I enroll in the Medical Flexible Spending Account?

Whether you are enrolling for the first time, or continuing to participate in the new plan year, you would need to complete a csONE Flex Enrollment Form, to designate the total amount you have decided to set aside, and to acknowledge the weekly payroll deduction amount.

Once you have made an election, unless you experience a qualifying event, you are unable to make changes until the next open enrollment period.

How do I access my account?

Once you have enrolled in your FSA, you can access your csONE account by going to www.csONE.com

Carrier Contact Information

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

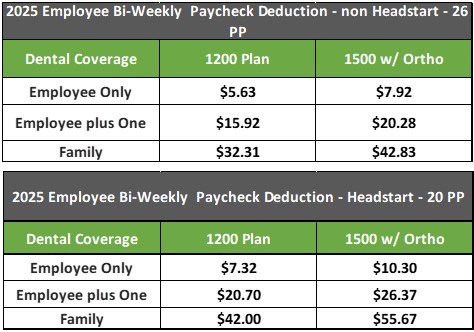

Dental Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible, beginning on the first of the month, following 30 days of employment.

Summary of Benefits and Coverages

Plan Overview

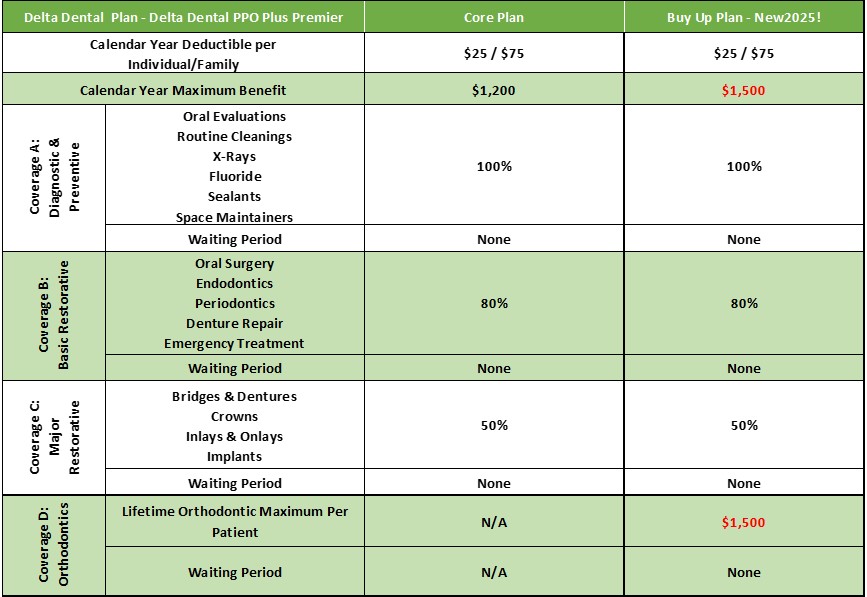

SCS offers 2 dentals plan through Northeast Delta Dental, operating on the PPO Plus Premier Network. Under Coverage A: Diagnostic & Preventive, the plans provides 4 cleanings in a 12-month period.

*New* for 2025, SCS is now offering a second Buy-Up Plan which includes Orthodontic coverage for both children and adults.

The chart below provides a high level overview of the dental plan designs and features offered to eligible employees by SCS. You can also find your per pay period contributions/premiums below.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Plan Documents

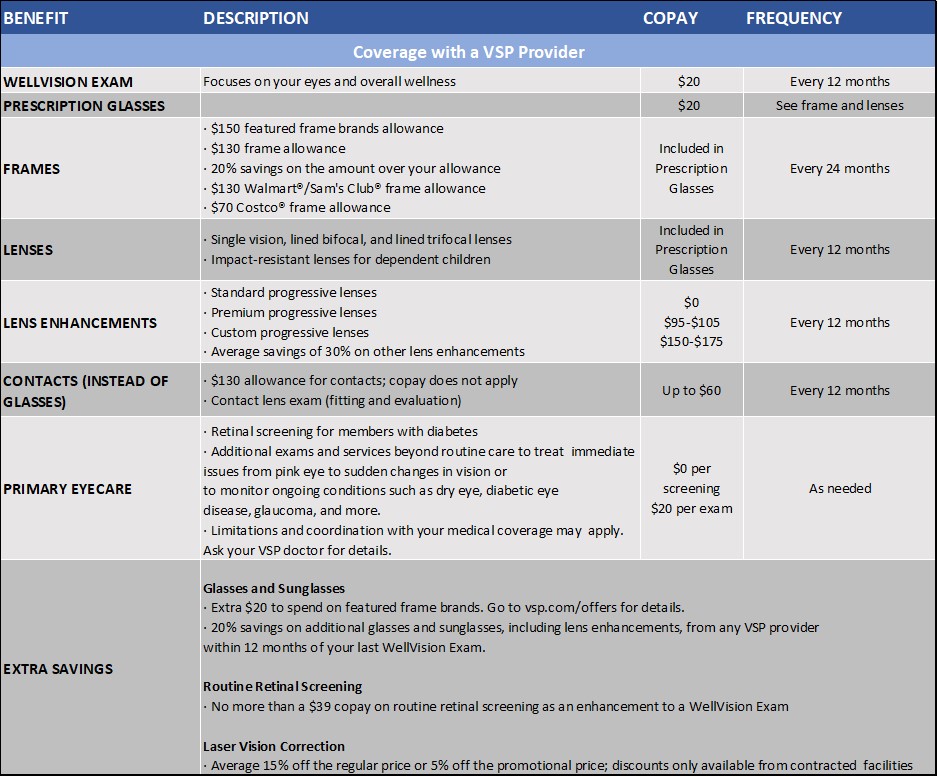

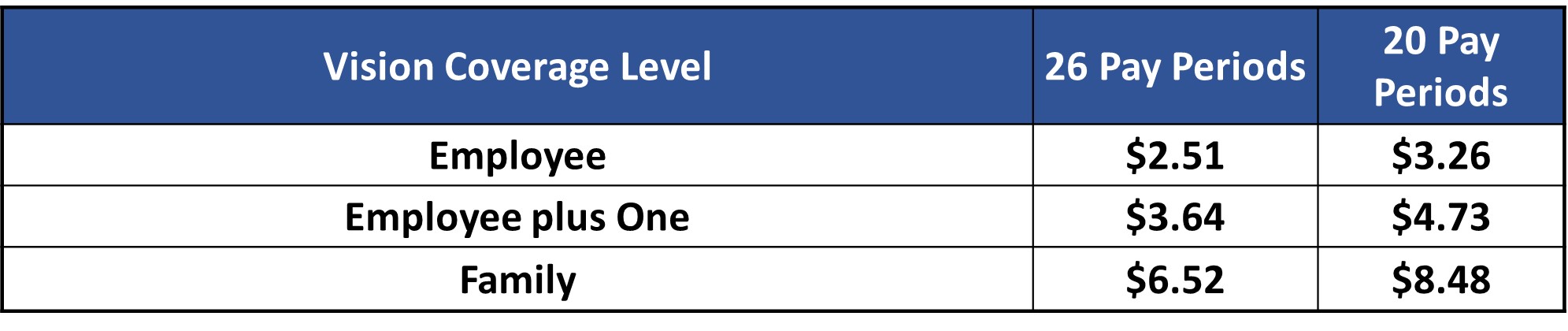

Vision Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible, beginning on the first of the month, following 30 days of employment.

Summary of Benefits and Coverages

Plan Overview

Southwestern Community Services offers a Vision plan through VSP, utilizing the VSP Choice network. Employees will receive a greater savings and lower cost by using in-network providers. To find out more about out-of-network services, please contact customer service at 1-800-877-7195 or go to www.vsp.com. If there are discrepancies between summary below and VSP produced materials, please rely on the latter.

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Plan Documents

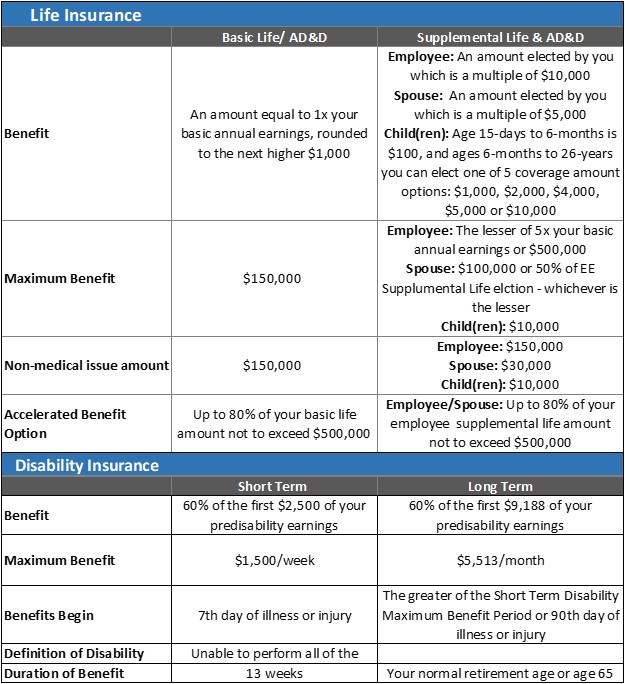

Group Life & AD&D Insurance

Summary of Group Basic Life and AD&D Benefits and Coverages

Eligibility

All Active, Full-Time employees who work 30+ hours per week are eligible on the 1st of the month following 30 days of employment.

Insurance can play an important role in reducing financial stress when a family is faced with the pre-mature death or disability of a wage-earner.

To help employees during critical times of need, through MetLife, SCS provides employer paid Life Insurance to all regular, full-time employees who work 30+ hours a week. New employees become eligible on the first of the month following 30 days of employment.

Summary of Supplemental Life and AD&D Benefits and Coverages

Eligibility

All Active, Full-Time employees who work 30+ hours per week are eligible on the 1st of the month following 30 days of employment.

Families have unique circumstances and financial needs. SCS offers its Full-time employees who work 30+ hours per week, the opportunity to elect Supplemental Employee Life & AD&D Insurance for themselves, their spouse and/or child(ren).

Carrier Contact Information

![]()

MetLife: Basic Life and AD&D, Supplemental Life

Customer Service: 800-638-5433

Website: www.metlife.com

Contributions

Group Basic Life and AD&D is 100% paid for by Southwestern Community Services.

Supplemental Life and AD&D is 100% paid for by employees.

Forms & Plan Documents

Short-Term Disability and Long-Term Disability Insurance

Eligibility

All Full-Time employees who work 30 or more hours per week are eligible beginning on the first of the month following 30 days of employment.

Summary of Benefits and Coverages

Most people don’t think about being disabled and unable to bring home their paycheck. Your financial obligations and living expenses don’t stop when you become disabled. Disability insurance can play an important role in reducing financial stress when facing the disability of a wage-earner.

To help you during critical times of need, through MetLife, SCS provides employer paid Short and Long Term Disability insurance to all full-time employees who work 30+ hours per week. New employees become eligible on the first of the month following 30 days of employment.

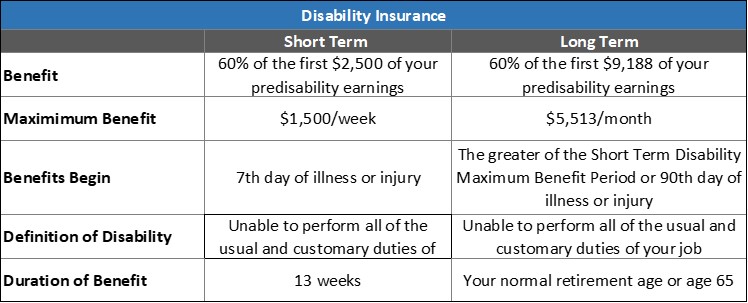

Below is a table outlining the benefits coverage:

Carrier Contact Information

![]()

Lincoln Financial Group: Short-Term Disability Insurance & Long- Term Disability Insurance

Customer Service: 800-638-5433

Website: www.metlife.com

Forms & Plan Documents

Employee Assistance Program

Eligibility

All employees and their family members are eligible upon hire.

Program Details

When you are facing new challenges, it’s helpful to have someone in your corner to listen, offer advice, and point you in the right direction for additional help. Southwestern Community Services provides an Employee Assistance Programs (EAP) available to all employees and their families through TotalCare EAP.

Just as health insurance addresses your physical health, your EAP benefits help with your emotional and mental well-being. And your EAP benefits also include much more than just help for problems – we have a host of benefits and opportunities to help you grow professionally, save money, improve your health, and enhance your personal life! Best of all, because your employer has covered the cost of services, there is no cost to you.

Getting the help, you need is simple. Call the EAP 24 hours a day, 7 days a week to reach a professional counselor via our toll-free number, 800-252-4555, or log on to our website to access other benefits at www.theEAP.com.

COUNSELING BENEFITS

Many complex issues are best resolved with counseling assistance from a behavioral health professional. You will want to consider calling for help if you encounter problems such as:

- Relationship and family issues

- Depression, stress, or anxiety

- Grief or loss of a loved one

- Eating disorders or substance abuse

- Workplace difficulties

When you call, you connect immediately with a counselor. Each of our experienced counselors has a Masters or Ph.D. level of training. Should you need to be referred to a local counselor for personal visits, we have more than 40,000 providers available to ensure that you will have a counselor near your home or workplace.

PEAK PERFORMANCE COACHING

Personal and professional coaching is available from senior-level ESI coaches. Get one-to-one telephonic coaching and support, as well as online self-help resources and trainings. Coaching is available for:

- Certified Financial Coaching

- Balancing Life at Work and Home

- Resilience

- Effective Communication

- Home Purchasing

- Student Debt

- Yoga & Relaxation for Beginners

- Workplace Conflict

- Retirement (Practical & Emotional Aspects)

- Succeeding as a Supervisor

WORK/LIFE BENEFITS

Help for personal, family, financial, and legal issues is available for your everyday work/life problems, including:

- Debt counseling and restructuring

- Legal problems not related to employment or medical concerns

- Childcare and elder care assistance

- Financial information

- Caregiver help and resources

- Real estate and tenant/landlord concerns

- Interpersonal skills with family and co-workers

- Pet Help Center

SELF-HELP RESOURCES

Access thousands of tools and informative articles covering virtually every problem you might face. You can call or log on to the website to access these benefits. Resources include:

- Behavioral Health – information on everything from alcohol abuse to personal stress

- Financial – articles and tools to help answer your questions and learn money management

- Legal Information – topics ranging from adoption to wills

- Tools for Tough Times – resources to help you do more with less in difficult financial times

LIFESTYLE SAVINGS BENEFITS

Your Lifestyle Savings Benefits include thousands of specially negotiated ways to shop, travel, entertain, and improve your health and your quality of life. Explore deals, discounts, and perks from your favorite national brands.

WELLNESS BENEFITS

The EAP wellness benefit allows you to access information and resources to improve you and your family’s overall wellness including stress reduction, fitness, diet and smoking cessation. Online Wellness Center One-to-One Wellness Coaching from certified coaches for nutrition, weight loss, fitness, reducing stress and quitting tobacco.

PERSONAL DEVELOPMENT AND TRAINING BENEFITS

Our online training includes more than 8,000 eLearning courses, trainings, and videos to help you boost your personal and professional growth. Balance your work, life, and career objectives with the help of tutorials, exercises, and worksheets.

403(b) Retirement Plan

403 (b) Retirement Plan

Southwestern Community Services offers employees the opportunity to safely and conveniently save for their retirement by offering a 403(b). Employees may choose to make Pre-Tax contributions or After-Tax (Roth) contributions.

There is no minimum age to participate. Employees are eligible to contribute day one. Employees who have worked at least 1000 hours in a 12-month period will be eligible for the match. Employees who work fewer than 1000 hours will not become eligible for the match until the end of the first plan year in which they complete 1000 hours of service.

Enrollment

Every employee who satisfies the requirements will have an opportunity to enroll in and contribute to the plan. To enroll in this plan, you should submit a “salary reduction agreement” and enrollment information.

If you do not make an election within the timeframe provided in the notice, you will be automatically enrolled in the plan, and we will automatically withhold:

- 2% from your salary for the initial Plan Year in which your Automatic Enrollment contributions commenced;

- 2% for the next plan year (following the plan year in which your Automatic Enrollment commenced) ;

- 3% for the next plan year;

- 4% for the next plan year;

- and 5% for the next (and each subsequent) plan year

403(b) Plan Details

In 2025, the Before Tax amount is between 1% and 100% of your compensation or $23,000.00*, whichever is less. Participants turning age 50 or older in 2025, may contribute an additional $7,500.00*.

Vesting is the percentage you are entitled to receive upon a distributable event. Employee contributions are always 100% vested.

Southwestern Community Services provides a matching contribution on your behalf equal to 200% of the salary reduction amount you are contributing during the plan year that does not exceed 5% of your compensation received during the plan year.

A wide array of investment options is available through your Plan. Please review the Plan’s Summary Plan Description or your plan administrator for more details.

*Subject to change once the IRS releases the 2025 contribution limits in late Fall 2024.

EAP Contact Information

Documents & Summaries

Voluntary Pet Insurance Benefits

Eligibility

On Staff Employees are eligible to purchase pet insurance through MetLife at discounted rates.

What makes Pin Paws Pet Care different from other pet insurance companies?

• Coverage for cats and dogs of all ages and breeds

• No initial exam/past vet notes required

• Accident coverage starts at midnight

• Customizable deductible and out-of-pocket max

• Annual max payouts as opposed to per incident

• Choose your reimbursement percentage

• Multiple value-added benefits included

• Routine care options available with customized plans

• Available in all 50 states

How do I enroll?

Enrollment is available at any time (not limited to Open Enrollment window or

new hire eligibility).

To enroll, visit: PinPaws.com/scshelps, and follow the steps for enrollment.

Depending on your dog or cat, and which plan you choose, your monthly premium will vary. You will need to pay with a personal credit card to sign up.

Contact Information

Contributions

Employees will be responsible for paying premiums through Pin Paws.

Additional Information

Aflac Voluntary Benefits

Eligibility

On Staff Employees are eligible to purchase supplemental coverages through Aflac.

How can Aflac help me?

Aflac will make cash payments directly to you, to be used however you choose, in the event that you have a qualifying claim. You can choose:

- Accident Coverage – Supplemental Accident Insurance that helps with what your health insurance plan might not cover.

- Critical Illness Coverage – Critical Illness insurance helps with the treatment costs of life-changing illnesses and health events, like a stroke or heart attack.

- Hospital Protection – Hospital Insurance helps with the expenses not covered by major medical.

- Cancer Indemnity – Cancer Insurance is here to help you and your family better cope financially—and emotionally—if a positive diagnosis of cancer ever occurs.

- Vision Coverage – Aflac Vision Plan is designed so individuals and their families can be more proactive about caring for their vision.

How do I enroll?

To enroll or make changes for the upcoming year, contact your local agent:

Vanessa Long

Phone: (937) 681-0354

email: vanessa_long@us.aflac.com

EAP Contact Information

Additional Benefits and Opportunities

SCS cares about you and your household members and wants each of their employees to strive to be their best selves. Therefore, they offer many additional benefits and opportunities.

Babies at Work

Babies at Work is a benefit provided to employees, when appropriate for the program department, which allows an employee with a newborn (0-6 months) to bring their baby to work.

This provides additional time for the baby and parent to bond, allows for ease of breastfeeding, and gives the family a more gradual transition to childcare options.

Who is Eligible: Both full-time and part-time employees, if the program is conducive to a Babies at Work arrangement Documents Needed: there are documents specific to Babies at Work, including the written policy and program agreement

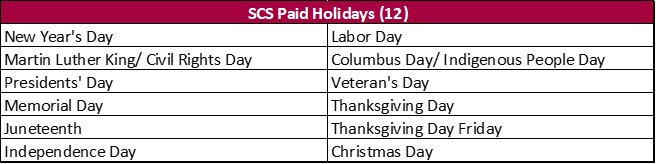

12 Paid Holidays

3 Paid Bereavement Days

SCS offers 3 paid days in addition to the holidays and Paid Time Off to help those who have recently lost a loved one the time to grieve and heal.

It’s important to remember that you also have access to your employee assistance program through TotalCare if you need additional support.

Professional Development and Training Opportunities

SCS wants their employees to succeed at all levels in their life and career. Therefore, they strongly encourage individuals to participate in professional development and training opportunities that are available in-person and virtual.

For a full list of the additional benefits and opportunities SCS offers please reach out to HR.

Paid Time Off (PTO)

SCS has established an accrual policy for paid time off (PTO), which provides regular employees paid time off to be used for vacation, illness, bereavement, or other personal needs. PTO accrues bi-weekly for employees, based on the following schedule, and is posted on each bi-weekly paystub.

Part-time regular employees who work at least 20 hours per week are eligible for a prorated numbers of days, based on their percentage of the standard hours worked to full-time. Note: Temporary employees are not eligible to accrue PTO. SCS employees with accrued PTO are required to use that PTO when taking time off from work. Unpaid time off approval is at the discretion of the program director. Permission of the program director or his/her designee is required for all planned PTO. When taking PTO, employees must keep in mind the needs of their respective program and are required to notify their supervisor if they should need to miss work on an unplanned basis. Additionally, due to the nature of program operations, some SCS programs may need to limit the number of employees taking PTO on any given day, or to require that PTO be used during a certain time of year to correspond with the needs of the program operation. SCS program directors have the final authority to manage their employees scheduled PTO. Employees will be allowed to maintain a maximum balance of unused accrued PTO of thirty days. No further PTO will accrue until the balance falls below the maximum. When a regular employee resigns or otherwise voluntarily ends their employment with SCS, with a minimum of a two-week notice, they will be paid 100% of their PTO balance. If a regular employee is terminated involuntarily or gives less than the required two-week notice, then no PTO will be paid out unless the CEO has approved an alternative pay out.

Disability Bridge Pay

Each regular full-time employee will be eligible for up to five SCS disability days. The SCS disability pay bridges the gap during the one week waiting period for the submission of a short-term disability leave claim once in a twelve-month period. The use of SCS disability pay requires the submission of a short-term disability application signed by a medical professional to the Human Resources Director. Disability days are forfeited upon termination of employment and are not paid out to departing employees regardless of whether the departure is voluntary or involuntary.

EAP Contact Information

SCS Additional Benefits

Documents & Summaries

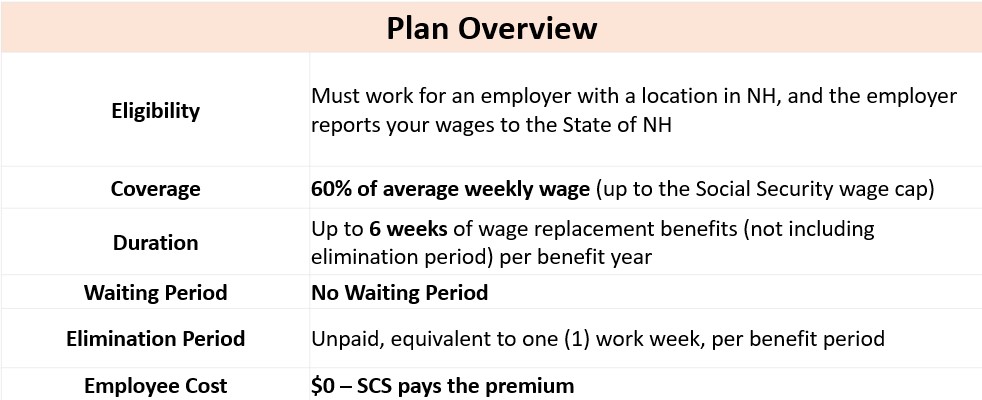

New Hampshire Paid Family & Medical Leave

New Hampshire Paid Family & Medical Leave (NHPFML)

New Hampshire Paid Family & Medical Leave is a voluntary insurance program for Paid leave for qualifying reasons. The State of NH PFML insurance partner, MetLife, administers the plan. Those who are already enrolled do not need to re-enroll.

Administered by : MetLife

MetLife Customer Solution Center: 866-595-7365

Website: https://www.paidfamilymedicalleave.nh.gov/

![]()

Additional Information

SmartConnect – Medicare Resource

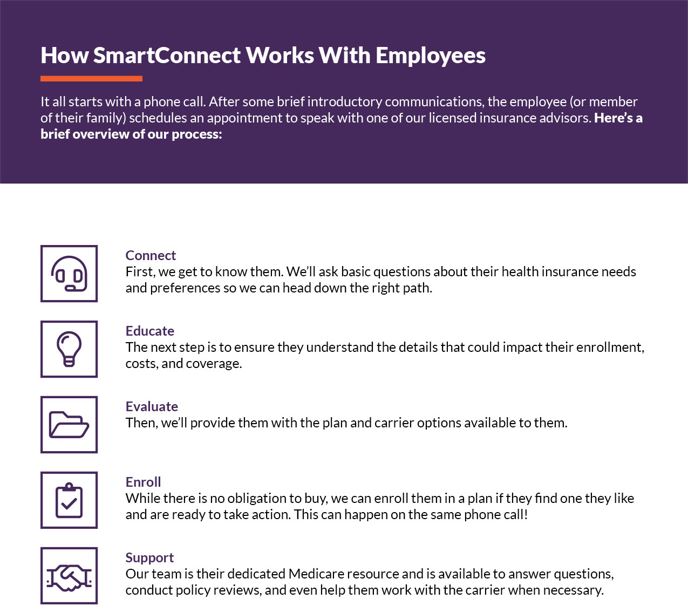

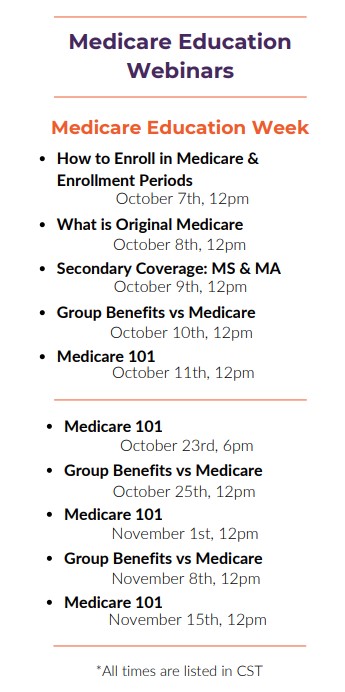

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information

SmartConnect- Medicare Resource

Tuition Assistance – GradFin

Southwestern Community Services tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

The Wellness Outlet

Southwestern Community Services offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/